Market sentiment across the national property market has largely been positive recently.

High clearance rates have been driven mainly by low levels of quality stock and an uplift in demand following the election result, multiple interest rate cuts, and higher loan borrowing capacities.

Here is an in depth look at each of the five major capital city property markets, with original content courtesy of Australian Property Investor magazine:

- Melbourne looks like it’s setting a price recovery trend

- Sydney property market has a spring in its step

- Brisbane market – slow but steady

- Adelaide prices remain steady

- Will Perth property takes the stairs or the elevator?

Melbourne

One month’s statistics do not make a trend. Three months, however, arguably does and a pattern of rising property prices is beginning to emerge in Melbourne.

With the median price for houses hitting $710,151 (units $530,923) according to the latest CoreLogic August figures, the gap has been closing since an earlier decline from its November 2017 peak.

The median property value is now 9.5 per cent below that benchmark level, performing strongly on the back of low levels of quality stock and multiple buyers.

A very strong market for rental properties this year has seen the vacancy rate slip below two per cent, encouraging investors to pursue relatively attractive yields.

According to Steve Janes, aussieproperty.com director, investor activity noticeably increased in August.

“Improved demand and low stocks for sale will almost certainly have an upward pressure on values, which is already being seen, most noticeably with the higher quality properties,” Mr. Janes said.

Spring invariably brings a blossoming supply of properties onto the market. But investors seeking improved returns on investment are expected to absorb any additional listings, according to Mr. Jane.

“All the drivers indicate a much safer investor environment to start or grow a portfolio and I suspect the risk here is on those who wait for prices to fall,” he said.

The tight supply of Melbourne properties was cited by Real Estate Buyers Agents Association of Australia (REBAA) president Cate Bakos as a key driver of the market.

“Not unlike most other winters, buyers seem to have forgotten that the typical supply and demand factors at play are soon to be turned in their favour,” Ms. Bakos said.

The surprise election and consecutive interest rate cuts seem to have buyers scrambling for property and many are breaking records and paying top dollar in fear of being priced out of their desired markets.”

She said auction properties for spring’s pre-school holiday weekends were already hitting the search engines and it was apparent buyers would have more stock to choose from as listings continued to roll out.

“Opportunities to purchase properties prior to auction are diminishing as vendors watch healthy sales results and make the decision to capitalise on the positive market conditions.

“Buyers are best advised not to break land-speed records in an attempt to secure a property before auction as we head into spring, and for two reasons: firstly, a bank valuation shortfall is a genuine risk if the purchaser pays a price substantially higher than a bank valuer would determine is appropriate, and secondly, the easing conditions, due to an equilibrium in supply and demand during spring, is likely to give way to some softer auction conditions for buyers.”

As lenders are adjusting their servicing buffers and passing on rate cuts, those who have not arranged pre-approval should do so, she said.

“They may find they are pleasantly surprised with their adjusted borrowing capacity.”

Rental affordability in Victoria improved over the June quarter, with the proportion of income required to meet median rent decreasing to 23.0 per cent, a fall of 0.1 percentage points over the quarter and a 0.3 per cent over the previous year.

Housing affordability remained steady in Victoria with the proportion of family income devoted to meeting average loan repayments at 32.5 per cent.

The number of loans to first home buyers in Victoria increased to 8,500, an increase of 18.0 per cent over the quarter but a decrease of 5.7 per cent compared to the June quarter 2018.

Sydney

A buoyant monthly growth in median dwelling values, auction clearance rates around 80 per cent and some excitable property market commentators spruiking imminent double-digit annual growth rates – welcome to the fluctuating fortunes of the Sydney property market.

For more than two years prices had been declining, to be down about 13.3 per cent from their peak in June 2017. But the first signs of recovery have brought the buyers out in time for the traditionally strong spring season.

Sydney real estate agents said while the number of available properties was thinning, there was no shortage of potential buyers.

That buyer confidence has returned thanks to falling interest rates, easing lending criteria since the Banking Royal Commission, and an election result that was seen to provide more certainty around issues such as negative gearing and investment rules.

Finn Simpson, business development manager at Belle Property Dee Why, said now could be the best time for investors to buy in the last two years.

“As spring is now upon us we’re seeing more tenants at open homes and while this hasn’t yet translated into an increase in rental figures, if increased competition is sustained then it’s only a matter of time before we see gradual increases,” Mr. Simpson said.

The volume of properties on the market is still relatively low, with sellers seemingly waiting for spring when conditions are historically better for good sales results.

Buyers upgrading to larger properties are fuelling renewed demand in Sydney, clamouring for the limited number of new homes up for grabs. Agents are reporting more activity from those keen to trade up as the market heads towards its next upswing.

Andrew Woodward, founder of The Investor’s Way, acknowledged the solid auction clearance rates, which are steadily increasing, but said supply remained the difficulty.

“The volume of properties on the market is still relatively low, as it appears sellers are waiting for spring, so it will be interesting to observe whether the sellers do come to the market in the coming weeks.”

David Mcelwain, aussieproperty.com.au portfolio manager, echoed those sentiments.

“Spring invariably brings with it some increase in consumer confidence but the current economic predictions are not overly positive and this may well impact the market yet again,” he said.

Mr. Mcelwain also said the rental market would dampen investor enthusiasm, with vacancy rates now at three percent, a full percentage point above the level deemed normal.

“More than 5,000 new properties hit the rental market last month and vacancy rates have indicated landlords should be looking after their tenants and not increasing rents arbitrarily, if at all,” he said.

“In times like these it is important to maintain good tenancies and in some cases even look at possible reductions in rent to maintain parity with what else is around and to show consideration for the tenants.”

Government incentives are expected to provide some solace to those trying to enter the property market.

The federal government recently introduced a bill to Parliament to fulfill its election pledge to help up to 10,000 first-home buyers a year into the market.

Under the First Home Loan Deposit Scheme, which is due to start on 1 January 2020, the government will provide guarantees to lenders that will allow first-home buyers to buy a property with a deposit of five per cent, instead of the usual 20 per cent.

At the other end of the market, Sydney’s median priced, established, blue-chip, inner-city property market has grown stronger since the election, according to Chris Gray, CEO of Your Empire.

“There’s always been a shortage of good quality properties, even in the downturn, and so with more buyers in the market, record prices are still being achieved and properties are still selling above expectations,” he said.

“There’s still a way for the market to go though and buyers need to be reminded that you’ve got to go for quality as that will always sell and rent well in any market.

“It’s much better to pay full price for a ten out of ten property than get a discount on a seven out of ten.”

Lower expectation for high rise

While most pundits are predicting a return to stable growth for Sydney’s housing market, hopes are lower for high rise apartments.

A spate of building quality issues have beset the construction industry, scaring off many investors in a sector already overstocked with existing and developing projects.

Mr. Simpson said investors needed to be wary.

“Buying in big off-the-plan projects is a risk at the moment,” he said.

“If the recent building issues all over the country aren’t enough to scare you off, these properties are also likely to see sub-par rent increases over the next couple of years due to the increase in stock,” he said.

Mr. Gray also identified the high-rise market as a one in which buyers should drive hard bargains.

“Overseas buyers still have issues with getting finance and justifying the high taxes and the local buyers are becoming cautious with all the media around building defects.

“If you are in the market for a brand new property, it’s a great time to negotiate as this market is bound to come back in time, with potential value if the original purchase is made astutely.”

Brisbane

Slow and steady is the best way to describe the performance of the Brisbane property market so far in the nationwide recovery in property markets around the country since May this year. The current data shows that for the second consecutive month, Brisbane property values have increased, which confirms what we have been reporting from being on the ground every day. Let’s explore what this means for property buyers.

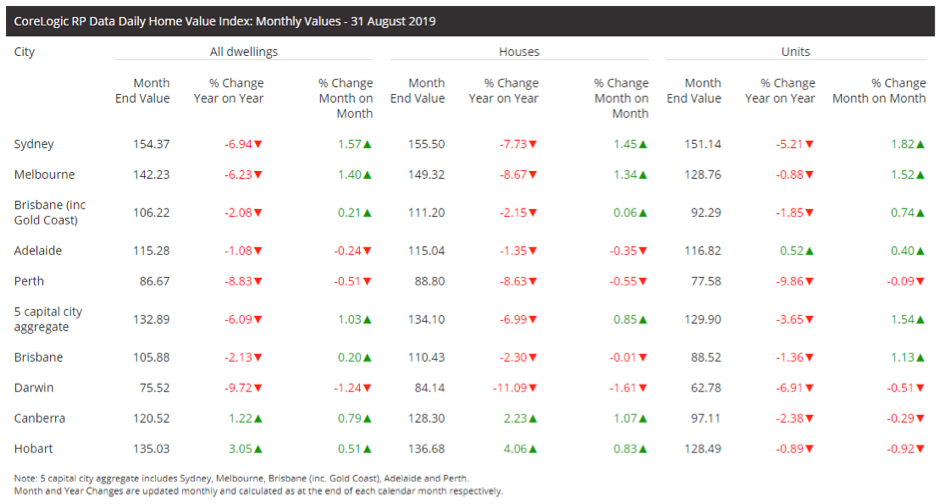

Corelogic data released on 31st August 2019 shows that Brisbane dwelling values increased a modest 0.2% across the month, the same price growth that was reported in the previous month.

Source: Corelogic

Underlying demand continues to remain strong with more homebuyers recently entering the Brisbane market as well as increased investor interest – especially from the southern states. Every property that we have purchased over the last 3 months on behalf of clients (that was not off-market or for sale by auction) has resulted in a “Multi-Offer” situation where more than one buyer had submitted an offer to buy the property at the same time. These properties were also all new listings … have been on the market for less than 7 days by the time they went under contract. This is a further demonstration of very high demand from buyers for quality properties that are well located.

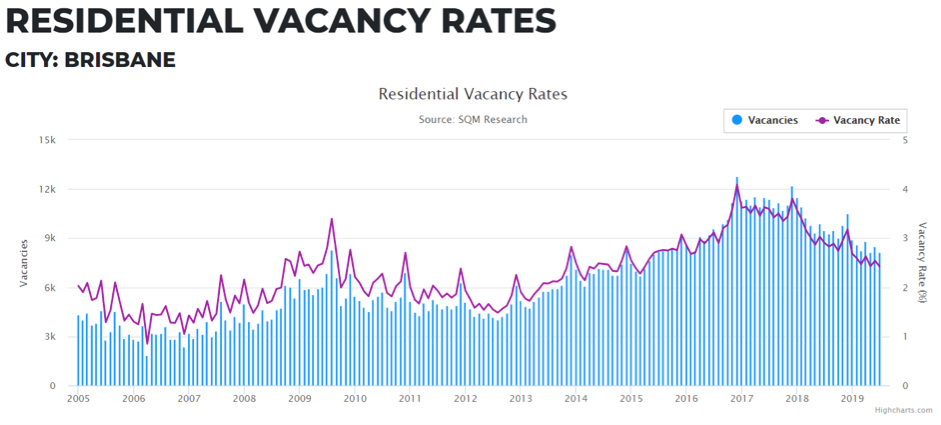

Brisbane still presents as a very attractive investment option for investors due to our strong rental yields and relative affordability in comparison to Melbourne and Sydney. Rental rates increased again in Brisbane over the month of August with gross rental yields in the greater Brisbane region at 4.6%, up from 4.4% this time last year. Overall, our vacancy rates are also trending downward which shows there are less properties left vacant for extended periods of time – another positive for investors.

Source: SQM Research

Of course, it is necessary to consider the vacancy rates on a suburb by suburb basis as this trend does depend on more local drivers in an area.

We are still finding that well-priced, good quality properties across Brisbane are more scarce at the moment, and there are fewer of them being offered for sale. Of course, this limits the “supply” side of the equation in determining property price growth. Coming into Spring, we are expecting more properties to become available for sale and this is further supported by early indications that vendors are gearing up for the spring selling season because property stylists – who dress the homes for sale- have reported a marked increase in business. https://www.domain.com.au/news/the-early-indicators-that-show-vendors-are-gearing-up-for-the-spring-selling-season-868868/

At the moment, we are still monitoring unit supply with a certain level of caution – especially in the inner city market. The two precincts in the inner north (Fortitude Valley, Newstead and Bowen Hills) and the inner south (South Brisbane and West End) have accounted for 49% of inner-city medium and high-density building approvals (just over 14,000 units) over the past five and a half years according to the Residential Property Market Report (2019) by CBRE. Residential Property Market Report (2019) by CBRE. Since 2016, these precincts have accounted for a 70% increase in stock with 10,500 units completed.

Whilst the development cycle in the inner city unit cycle has effectively come to a halt, there are a further 14,500+ units currently either under construction or with a development approval in place. Whilst it is likely that many of these are on hold at present, property buyers need to understand how another wave of hyper development may impact on property values in this region, as well as surrounding areas such as Wooloongabba, Dutton Park and even the CBD where new or upgraded rail stations will be developed as a result of the cross-river rail project which is currently under construction.

The shift in Brisbane dwelling values is consistent with price movements in Sydney and Melbourne in August as well. We believe that buyer demand and confidence is responding well to the positive effect of a stable federal government, as well as lower interest rates and the easing in credit policy. We remain optimistic about the months ahead.

Adelaide

The story of the Adelaide property market continues to be one of resilience. Against a backdrop of falling prices across the country, Adelaide property prices have held strong.

This is highlighted by the fact that since the peak, prices are off only -1.5% according to the latest data from Corelogic. The South Australian capital has performed very favourably in comparison to other markets such as Sydney, Melbourne and even Perth who have all seen double-digit falls.

Notably, Adelaide has presented the third strongest property market in the country, behind only Hobart and Canberra over the past 12 months. The strength has remained throughout a period when many investors were nervous about the state of the housing market after the local auto-market shut down in 2017 taking a number of jobs with it.

According to Corelogic, the month of August saw a small -0.2% change in property prices, but overall the trend appears to be headed upwards. The median house price in Adelaide is $461,651, while units are currently $321,506.

Some of this strength can be attributed to a low vacancy rate that is sitting at 1.1%. At the same time, the most recent auction results out of Adelaide and South Australia continue to be pleasing for vendors, with the clearance rate sitting around 62.5% for a number of weeks.

The latest figures from the Valuer-General for the 2019 June quarter, showed the same type of strength in the housing market with an increase of 2.38% over the past year.

The top-performing suburbs over the last year were Unley, Rosewater and Torrensville while Brighton, Stonyfell and Aldgate all showed good growth according to the Valuer-General.

REISA Vice President Mr. Robin Turner said that the latest results showed that all was well in the South Australian real estate market and that confidence had returned to both vendors and buyers with realistically priced properties selling readily.

“The latest figures show a significant growth in median price over the last 12 months and a substantial increase in the number of sales over the last quarter. It is also encouraging that the median price has remained around the record-breaking median posted last quarter. Adelaide is still a most affordable city and these results clearly indicate that South Australia is appealing to both home buyers and investors alike,” said the Vice President.

“There was an increase of almost 10% in the number of sales since the last quarter across metropolitan Adelaide and about 6% across South Australia. Capital growth is one thing but when this is combined with increases in numbers of sales, it shows great confidence in South Australia”.

“Location and affordability will always be the key drivers of a purchaser’s decision to either buy or invest in property. Affordability particularly when coupled with existing or exciting new infrastructure will always deliver suburbs that do well for first home buyers.

“Likewise, these suburbs will be seen as very attractive opportunities for investment. Location, in particular, proximity to the beach will always prove popular in offering lifestyle changes or recreational activities,” said Mr. Turner.

Katherine Skinner, director of National Property Buyers believes that buyers are changing tact as we head into spring and August is looking like a real turning point.

“The month of August saw a stark contrast in activity between the first half of the month and the last, as well as general feel in the market. Early August we felt the desperation of investors wanting to jump into poor investment choices just to make a purchase, whereas now, there is an air of calm and calculation felt among investors we are seeing some solid options,” said Mrs. Skinner.

“While investor sentiment has remained strong, the previously low stock levels which we saw over the winter months made purchasing high-performance investment properties difficult for many investors.”

“By the end of August, the market has seen a steady increase in quality investment grade stock ready to be snapped up by savvy investors, and they are being sold within days of hitting the market.”

“We are expecting to see significant growth with this continued momentum over the spring quarter in certain pockets within the metropolitan area, especially within the North-Eastern Suburbs and Inner West.”

Perth

There is an age-old proverb that the share market takes the stairs up and the elevator down.

But for the Perth property market, the opposite has largely been the case over the past couple of decades.

Riding the 2000s elevator to median prices that surpassed Melbourne and neared Sydney levels, Perth prices were soaring annually in double-digit percentages. The past half dozen years, however, have seen prices unwind, as they’ve meandered down the stairs at around three to five per cent per year.

While prices doubled and even tripled through the 2000s, the stroll down the stairs has now sliced 20 per cent from the value of Perth properties since June 2014.

The WA capital remains the weakest performing capital city in Australia, marking a fall from grace since the heady days of the mining boom. The latest Core Logic figures show the city posted a decline in housing and unit values of 1.8% in the three months to August, and a further 2% last month, reinforcing a sense of market wariness.

According to the Real Estate Institute of WA (Reiwa), the median house price dropped from $490,000 last month to $486,000 and the number of properties listed for sale was at its lowest level since late 2014. Rents and yields remained stable.

To borrow from another cautionary stock market adage about trying to catch a falling knife, Perth market watchers are wondering whether they should risk being cut timing the bottom of the market.

There are signs of hope.

Nationally, housing construction dropped to its lowest level in 19 years but WA was the only state to have posted a lift in construction projects.

Licia Santoriello, director of Property Selection Realty, said it was the lower and mid-tiers of the housing market that were faring best.

“First home buyers and investors are taking advantage of the low housing prices to secure their first home or investment property.

“With properties selling, it stimulates the property market and boosts confidence,” she said.

This sentiment was supported by the industry number crunchers, with first home buyers in WA increasing to 3,473 in the June quarter, an increase of 4.8 per cent over the quarter

The gradual construction pick-up reflected the low base prices that were seeing buyers filter back into the market.

“As land has never been more affordable, builders are snapping up land to subdivide and sell as vacant land or build strata villas.

“Either way, it allows buyers who previously could not afford to buy to enter the property market and this activity stimulates the economy, providing much-needed work for those in this industry,” said Santoriello.

Over the past few decades, Perth suburbs and city precincts have been transformed as apartments increase population densities across the metropolitan area. The rapid growth in the apartment market has in recent years eclipsed demand, but this may be about to change.

“In the short term, houses are outperforming apartments, however, taking a longer-term view, apartments will become more popular as they have become more affordable”

The offer of benefits such as swimming pools, convenient locations and easy care living will only add to their allure.

REIWA president Damian Collins said on Perth radio that the city’s population needed to grow before prices would take any significant upturn.

“The first homeowners grant moved to new properties, which encouraged people to build a new home, right at the time WA was losing population,” he said.

The subsequent increase in housing stocks has kept a lid on prices.

According to Ms. Santoriello, it is a good time for first home buyers and those looking to upgrade to a family-sized suburban home to make their move. “Buyers are looking to spend under a million dollars – anything above that is struggling to sell.”

References

[1] Australian Property Investor, API September market update, published 19 September 2019

—

Long Property blog content provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Nothing on the Long Property website constitutes legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.