Podcast: Play in new window | Download

Subscribe: RSS

Over 40 years ago he bought his first property in the Melbourne suburb of Hawthorn. In three years it nearly doubled in value and at the tender age of 21 he thought he’d stumbled upon the world’s greatest get-rich-quick scheme!

Buoyed with confidence, he then took the same strategy that had worked for him in Hawthorn, and repeated it… but this time prices went backwards, and the investment actually lost money.

John Lindeman would then make it his mission to understand how the Australian housing market worked.

40+ years later, and after having devoted his life’s work to this study, John Lindeman is now one of Australia’s leading property authorities.

John studied demand trend analytics at the Australian Bureau of Statistics and later served as the leading researcher at major data providers to the real estate and banking industries for over 10 years.

It’s the rigor of John’s quantitative research which separates him from other market analysts.

A few years ago John was awarded an innovation patent for the predictive modeling techniques he developed to determine with over 90% accuracy whether prices in a particular suburb are likely to go up or down.

John was the first person to put this into a format that regular everyday investors could both understand and utilise.

John also went on to author “Mastering the Australian Housing Market” now the seminal text for property investors in Australia. In 2015 he also released “Unlocking the Property Market” which explains where to find the best growth potential, and when to buy and sell.

Both texts were published by Wiley and can be purchased via Amazon here.

Somewhere in John’s hectic schedule of travel, research, speaking engagements and writing the monthly research column for Australian Property Investor Magazine, John found a spare half hour to speak with Long Property.

Our 30 minute interview covers a lot of ground but mainly focuses on John’s research methodologies, his personal investment experiences and also his current outlook on the Australian housing market.

We also cover:

- The shortcomings of the simple buy and hold investment strategy

- Seeking growth orientated investments in the early/building phase of your portfolio development, and then transitioning to higher income producing assets as you approach retirement

- How the trend of rising rental vacancies prompted John to exit his mining town investments prior to the crash

- What happens when over 20% of Australia reaches retirement age, and has the bulk of their wealth tied up in their family home

- The investment case for cheap, accessible, low maintenance, regional and/or coastal properties, where older people are starting to move to

John’s key tip for investors is:

Increasing rental vacancies are a sign that prices may soon fall

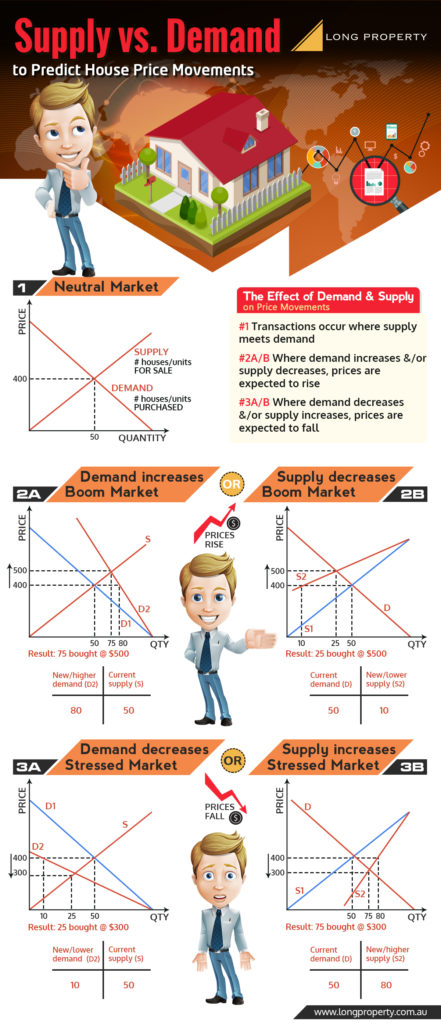

Free Infographic – Supply & Demand Indicators to Predict House Price Movements

As you will learn from our interview, the study of demand and supply indicators is really what underpins the majority of John’s research.

“Supply” can be modeled on the number of houses/units for sale in a particular market, and “demand” is modeled by the number of houses/units that have been recently purchased.

We have developed the below Infographic which illustrates how this works. We hope you find it useful as a convenient reference for better understanding John’s approach.

When demand increases and/or supply decreases, the result is that prices tend to rise (figures #2A and #2B). Conversely when demand decreases and/or supply increases, the result is that prices will generally fall (figures #3A and #3B).

On a monthly basis John uses this type of analysis, albeit far more advanced, to predict house price movements in over 15,000 suburbs around the country.

He then conducts extensive on-the-ground research to better understand “the why” behind what the numbers tell him.

Learn more about John’s research, educational programs and upcoming seminars at www.7steps2success.com.au

And without further ado, please enjoy our 30 minute Long Property interview, with John Lindeman.

(ensure you’re viewing this post in a web browser to access the audio link)