Article by Patrick Lynch, Head of Operations (with input by Dan Gold, broker)

In a recent blog, we set out some thoughts for those experiencing financial stress due to the economic effects of COVID19, including uncertainty as to how they would meet loan obligations. We now want to provide guidance for anyone who took a payment deferral and might be concerned about what will happen when payments restart…

Where are we?

According to the Australian Banking Association, Banks have deferred the repayments of one in fourteen (429,000) mortgages, totalling $153.5 billion, to assist Australians through the COVID19 pandemic. Including other loans, 703,000 loans worth $211 billion were deferred.

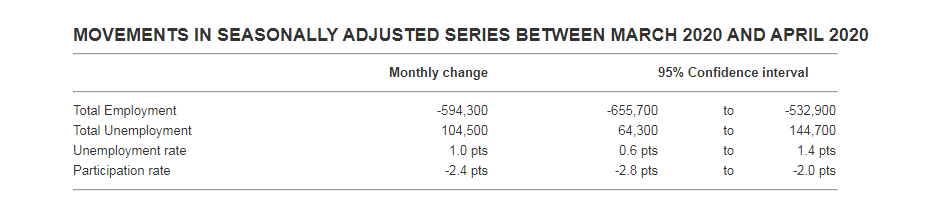

The Australian Bureau of Statistics April report showed an unemployment rate of 6.2% (up 1%). However, this under represents the actual effect of COVID19 – almost 600,000 lost their jobs, but unemployment only increased by 104,500. Why the difference? The rest left the labour force – they were neither working nor unemployed because they were not actively looking for work.

Consider also those still employed but on reduced hours or pay cuts, because the businesses they work for have seen drops in sales. The underemployment rate (13.7%, up 4.9%), participation rate (63.5%, down 2.4%) and hours worked (down 8%) might also be considered relevant.

The economy has been helped by the Government’s income supports, without which the stats would look much worse:

- Job Keeper – a temporary subsidy for businesses significantly affected by COVID19. Eligible employers, sole traders and other entities could apply to receive $1,500 per eligible employee per fortnight. There are over 3.5 million people and 900,000 entities enrolled (est. $70 billion cost).

- Job Seeker – There are also many benefitting from the increased Job Seeker payment of $1,100 per fortnight (about twice the standard $40 per day).

What next?

We think further support is necessary and likely.

Initial loan deferrals granted in March/ April are scheduled to end in September/ October, potentially coinciding with the ending of Job Keeper (and increased Job Seeker). Participants in the economy need to have confidence that the relevant players are doing everything possible to limit long-term damage.

The Government is believed to be reviewing Job Keeper. A narrowing of eligibility is likely, so the scheme can target those hardest-hit sectors, albeit with the tests tightened and the payment reduced. A complete stop would risk the economy falling off a cliff, so tapering is necessary. However, the scheme could be extended to incorporate casual employees, those without citizenship or permanent residence (e.g. foreign students), etc. Job Seeker is also due to revert to the prior setting – somewhere in between the new and old levels could be more equitable and of long-term benefit.

Lenders who are willing to extend payment deferrals or consider amended repayment plans would assist borrowers to avoid defaulting. Some institutions (such as CBA) have started to encourage customers to end their 6-month repayment holidays early. We’ve seen some Lenders (e.g. Westpac) offer to extend Interest only periods for property investors. Without further support, we could see a heightened degree of distressed property sales which is not in the Banks’ interests. The ‘Big 4’ Banks have set-aside billions of dollars in provisions to cover loans that might not be repaid:

- ANZ $1.05 billion

- CBA $1.50 billion

- NAB $0.80 billion

- Westpac $1.60 billion

Remember, payment deferrals weren’t ‘free’ – interest continued to accrue and was added to the loan, with the increased balance to be paid off over the remaining shorter term via a higher monthly payment. If you feel uncertain that you’ll be able to restart repayments, it might be important to start planning. Speak with your Broker, Lender or Financial Planner/ Accountant.

If the repayment deferrals are extended in certain cases, there would be less downward pressure on house prices come Spring. Dan has provided his thoughts about the current state of the property market here.

Closing

Whether your employment and financial situation are in a good space or not, we encourage a regular review of your financial position. Long Property wishes everyone the best and asks that you look after your physical and mental health; we remain available to assist with your lending needs.

Long Property blog content provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Nothing on the Long Property website constitutes legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.