Article by Patrick Lynch, Head of Operations

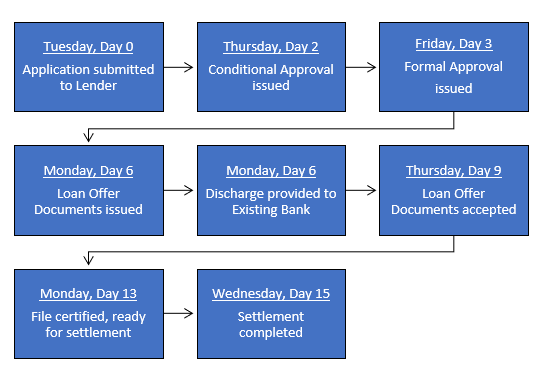

Does the perfect application exist and how quickly can an application move through the process from lodgement to settlement? In the current Lending environment, we think 15 days for a refinance (no escalations) is extraordinary. So how did this one happen?

It has to start with the applicant, following the strategy and structure meeting with the broker. We were fortunate to have just completed a purchase for this client 3 weeks earlier (which itself only took 4 weeks from lodgement to settlement, with a different Lender, from a standing start– i.e. no pre-approval). They were motivated and diligent in responding to requests for supporting documents, forms, additional information, etc. When loan documents were produced, they were accepted (once client queries had been answered) and conditions addressed without unnecessary delay.

The Lender and their settlement agents also played a strong part. Some Lenders are taking 3 weeks just to assess a submitted application. In this case, the Bank reviewed and conditionally approved the deal within c 36 hours of lodgement, with formal approval issued 1 day later. Settlement agents were then instructed to prepare the loan offer documents – straightforward, took 1 business day to issue. Another benefit of this Lender – loan documents can be signed electronically (apart from the Mortgage). Once we answered the client’s queries, these were accepted a few days’ later.

Remember this was a refinance, and we’ve seen some Lenders reluctant to lose business when volumes are down significantly – it doesn’t always happen, but sometimes the existing Bank will contact the client offering to match the new Lender’s terms to retain the relationship. This can make for an unwieldly and time-consuming discharge. Not here – discharge accepted within 1 week.

And so to settlement – a proposed date that would have added 2 weeks to the timeline was brought forward by all parties, the client completed their final requirement (debt pay-down to cover settlement costs), and deal done. The final timeline looks like the below, and it is important to note this was exceptional – all parties worked together to make it happen.

It wasn’t the most complicated of deals, but did involve a mix of salary, investment and rental income. And the outcome was perfect for the client – lower interest rate and extended interest only period.

An application begins with the broker determining the right structure and strategy for the client to obtain the optimum outcome. Strong, active and prompt communication thereafter by the broker’s client services team is crucial. The challenge for us at Long Property is to try and make every client experience a positive one, even in the most difficult of scenarios. We hope our existing clients can see we work hard and look forward to continuing this work with their support and that of our business and referral partners in lending, property, legal, accounting, financial planning, etc.

If you or someone you know has a lending need, we hope Long Property is top of your list.

—

Long Property blog content provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Nothing on the Long Property website constitutes legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.

Credit Representative Number 493530 authorised under Australian Credit Licence 389328