Article by Patrick Lynch, Head of Operations

With contributions from Dan Gold

At the start of 2019, we wrote a blog about Credit Reports that briefly touched on Comprehensive Credit Reporting. Well, almost exactly 1 year later, we’ve seen a few applications recently where the new reports being produced are having a big impact on Lending. We thought it essential that Borrowers know what’s happened, including a refresher on Comprehensive Credit Reporting and why it is important, the content of the new Credit Reports, and what you can do to not get caught out.

What is Comprehensive Credit Reporting (CCR)?

CCR (also known as Open Banking) is a new era for Australian finance and Credit Reports. Many institutions are now able to access, via Credit Rating Agencies, more information on your credit history than ever before.

Previously, Credit Reports contained only ‘negative’ information about your credit history – whether you had payment defaults, bankruptcies, court orders or judgements. The new system is more ‘positive’ in its reporting – it details the number and frequency of your credit enquiries, all recent active and inactive facilities, and the month to month repayment profile of your loans and credit cards. The initial legislation was introduced several years ago, but only recently were the Banks and other credit providers required to upload their data.

How aware are Consumers of CCR?

Most Australians won’t be aware of Comprehensive Credit Reporting, unless they’ve recently applied for credit, read the Long Property blog or listened to our latest Podcast! OK, that may be an stretch, but some recent statistics from leading credit reporting agency Experian are enlightening:

- 59% of survey respondents had never checked their credit score

- 48% were unaware that credit providers were sharing more personal financial information.

- Only 15% checked their scores regularly and 19% were unaware of what a credit score even was.

Why does it matter?

Previously, most Lenders required statements only for loans they were refinancing plus (in some instances) transactions accounts and any other active debt facilities. This provided them with a picture of a Borrower’s character and conduct. We are getting to the point where this won’t be needed, as the Credit Reports will enable them to see conduct on all debt facilities active during the last 2 years.

More than 30 credit providers in Australia are reporting under Comprehensive Credit Reporting – not just the Big 4, but many secondary banks and financial institutions have committed to supplying financial data as it helps them towards their responsible lending obligations. Lenders use the Credit Report as one part of the decisioning process and it is the full report (not just the score) that they are reviewing. Recently, we queried over a dozen Lenders and a significant majority are actively using CCR as part of their process.

CCR presents an opportunity to improve transparency (harder to not disclose debts) and competition in the financial industry and make the Australian financial system more robust. It can simplify the refinance process – reducing the amount of paperwork required when submitting applications and speeding up assessment.

As Lenders get access to more information, credit reports and scores should become more accurate. It is more important than ever for Borrowers to take the time to improve their awareness and financial literacy.

What is included in the new CCR credit reports?

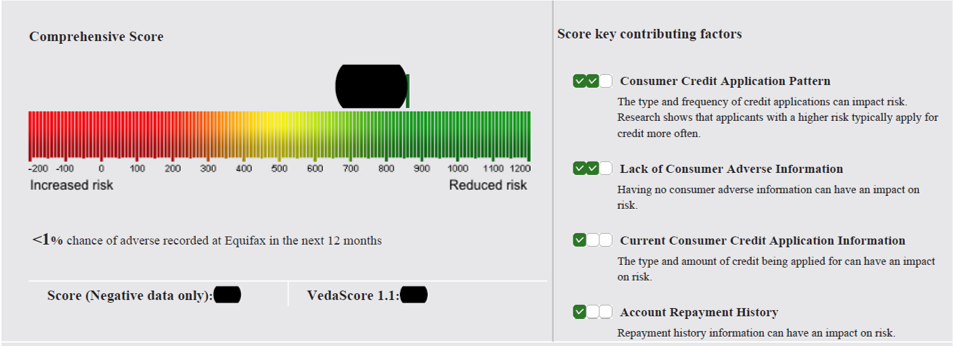

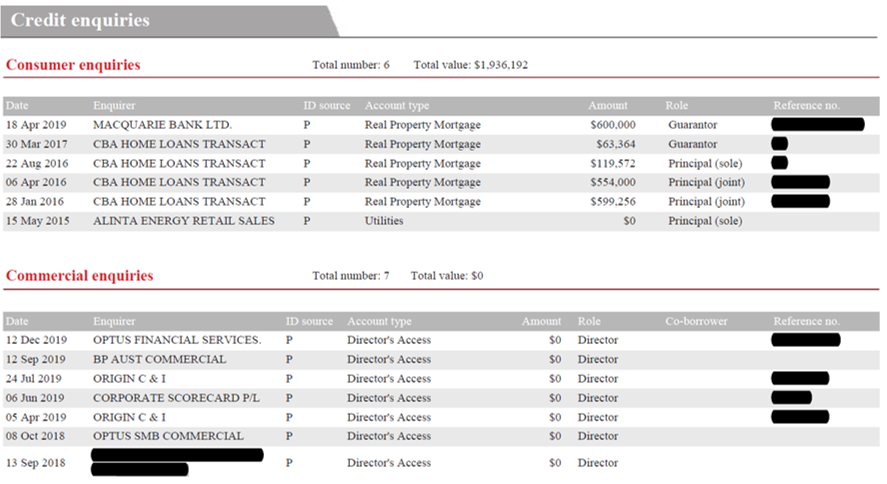

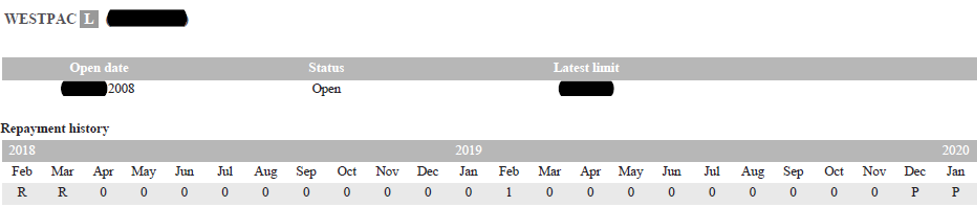

The main differences in credit reports before and since CCR are that the latter will show information including the credit type and amount applied for (for the most recent 5 years), when accounts were opened and closed, credit limits and repayment history (for the most recent 24 months). Although each Credit Agency’s reports will differ slightly, they will likely show the following (with anonymised screenshots):

- Credit score – summary of overall credit risk, displayed as a number.

- Summary of accounts held and adverse activity.

- Identity details – name, address, employment, etc.

- 5 years of consumer & commercial enquires – dates, credit provider, account type, amount and role.

- Insolvencies, defaults and court actions.

- Account details – including Credit provider, account numbers, dates, balances and 24-month history.

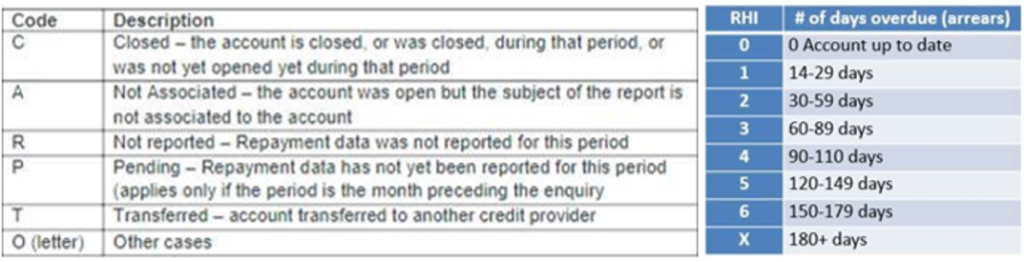

As you can see above, the repayment history shows a status code (letter or number) for each month. A ‘0’ means the payment was made on time (or, if missed, brought up to date within 14 days). However, if missed payments were not remedied until 14 to 29 days, this is a shown as a ‘1’. For each 30 days thereafter, the number gets worse until being over 6 months in arrears:

Any one missed payment will be questioned but tends to be fine, once there is a reasonable explanation (i.e. not simply ‘I forgot’; provide details of what happened, why and how it won’t happen again). Lenders may also require statements for both the facility itself and another account to show funds were available. Recent adverse conduct is seen as much worse than payments that were missed 6, 12 or 18 months ago.

However, consecutive or multiple instances of missed payments may affect your ability to borrow – there are plenty of Lenders who will immediately decline an application based on the Credit Report, not even reviewing whether the applicant has a strong income or asset position.

As a new process, implementation and accuracy will take time. Lenders will have more information on hand than ever, and this might lead to more queries from assessors. Anyone with good credit history should be able to access new credit and, as the process gets more sophisticated, may receive better loan terms.

What should you do?

If you think you can opt-out of Comprehensive Credit Reporting, no chance. By law, there is a requirement for the major Banks to share their customers’ financial information, and many smaller Lenders are also sharing. However, there are still some Lenders who are either not yet up-to-date or using the new reports in their assessment – eventually they will, and this will become the new standard for all applications.

The focus for Clients should be to know their credit score and profile, by contacting one of the Credit Reporting agencies for a copy of their own report. Everyone is entitled to 1 free report each 12 months, and they can be obtained from e.g. (click name to go to their website):

Once you have your report, check it is accurate. If you’re not sure of what it says, the Credit Reporting Agency will be able to assist (we’re also available). You have the right to have any errors or inconsistencies examined and fixed, by contacting the Credit Provider.

Some consumer advocates are worried about how this new reporting system might affect people experiencing financial hardship. If someone is in difficulty, the last thing they should do is hide. Contact the Credit Provider – yes, it may be embarrassing and there can be a worry how the Lender will react. Credit Providers take financial hardship seriously but prefer collaborative solutions where possible rather than needing to take potentially costly legal action for debt recovery (e.g. taking possession of and selling a home from under the owner).

There is legislation (National Consumer Credit Protection Act) and industry Codes of Practice to guide Lenders. Each case is different, so each response will be different (e.g. reduced or NIL payments until the position improves, or a co-operative exit through sale, payment plan, etc.). Contacting the Credit Provider could also help preserve the Borrower’s Credit Record by avoiding the listing of a default, which can make borrowing extremely tough outside of non-prime Lenders (with high rates and uncompetitive terms).

In Summary

The key takeaways we see for anyone looking to borrow are:

- It should become easier to apply for credit, with less paperwork required since the credit provider will be able to see everything via the new credit reports.

- There will be less opportunity or incentive for non-disclosure of debt as a result.

- Borrowers will need to take account management and financial stewardship more seriously, to not disadvantage their next application.

- The integrity of the reported data will improve over time. It is worth Borrowers checking their latest credit report (or have an adviser check on your behalf), to ensure what is stated is correct.

- Any facilities in arrears may be questioned, whereas previously they could have gone unnoticed.

- Lenders may implement risk-based pricing, with better offers to Borrowers perceived as lower risk.

- Each Credit Provider will have different policies on what is acceptable credit behaviour (e.g. scores, conduct, disclosure, etc.) and this may determine a Borrower’s lending options.

- If you get into (or foresee) financial difficulty, admit it and be up front with your Credit Provider.

The main thing to do is ensure that all repayments are made on time. Setting up automatic Direct Debits is a great way to achieve this, as manual payments can be missed or forgotten in the hurly-burly of life, family, work, etc. Ensure that accounts from which payments are being claimed have enough funds to meet each obligation as they come due.

Do you need to review your Credit? Long Property are available to assist.

Long Property blog content provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Nothing on the Long Property website constitutes legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.