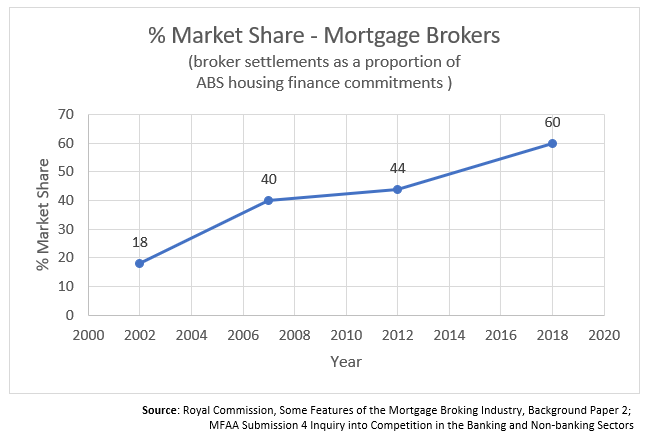

According to the latest data from CoreLogic, mortgage brokers settled 59.1% of all residential home loans in the September quarter 2018. [1]

This is an all-time record, and an exceptionally strong outcome for the mortgage broking industry.

To put this into context, broker market share was only at 18% in 2002! [2]

Mortgage broking was very much a new industry back then. Throughout the 1990’s there were mass lay-offs and hundreds of bank branch closures throughout Australia, this also coincided with many new non-bank Lenders entering the marketplace.

Consumers needed experienced operators to represent their borrowing interests and the pioneers of the mortgage broking industry capitalised on this opportunity.

The rise in broker popularity to 60% market share confirms that the mortgage broking channel is now clearly the first choice amongst Australians for obtaining housing finance.

In an environment where it’s becoming increasingly difficult to obtain a loan, my view is that borrowers will continuing seeking the expertise and more funding options that are made available via the broker channel – particularly given that the fees/ charges and interest rates are no different from branch lending, mobile banking or private banking.

Short of any curve balls that come out of the Royal Commission (final report due this Friday), I wouldn’t be surprised if broker market share surpasses 70% in the not too distant future.

Time will tell…

References

[1] Broker market share hits record high 59.1%, Connective Broker Resources, Accessed 28/01/2019

[2] Royal Commission, Some Features of the Mortgage Broking Industry, Background Paper 2, Accessed 27/01/2019

Long Property blog content provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Nothing on the Long Property website constitutes legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.

Credit Representative Number 493530 authorised under Australian Credit Licence 389328.