We’ve had a few clients surprised recently that despite their mortgage interest rates effectively tripling (e.g. from around 2 per cent when they initially fixed, to around 6 per cent now with variable rates), their month-to-month repayments aren’t increasing to the same extent…

I thought of putting this article together as a useful explainer.

To begin, assuming a rate increase from 2 per cent to 6 per cent, the tripling of repayments does actually occur when looking at Interest Only (rather than Principal & Interest, ‘P&I’) loan repayments.

Example Interest Only mortgage

| Interest rate | 2.0% | 6.0% (3.0x increase) |

| Repayments on say $1M loan | $1,667/mth | $5,000/mth (3.0x increase) |

Note the like-for-like increases, e.g. interest rate increase by 3.0x, Interest Only repayments also increase by 3.0x.

Example Principal & Interest ‘P&I’ mortgage

| Interest rate | 2.0% | 6.0% (3.0x increase) |

| Repayments on say $1M loan, assuming 30 yr loan term | $3,696/mth | $5,996/mth (1.6x increase) |

In this P&I scenario, the interest rate still increases 3.0x, however the P&I repayments only increase 1.6x.

The reason for this is because with a P&I loan, as the name suggests, a portion of each repayment goes towards Principal (e.g. reducing the loan balance), and a portion goes towards paying Interest.

So because the Interest aspect is only a portion of each repayment, increasing that single component doesn’t have an exact/ equivalent impact on the overall repayment amount.

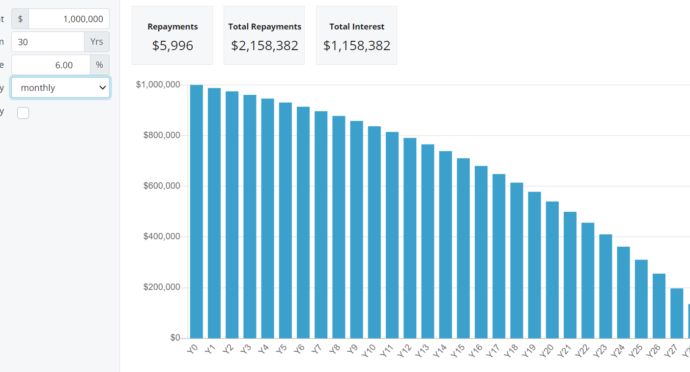

As illustrated by the diagrams below, what does happen with P&I loans in a higher interest rate environment is that a larger portion of each repayment goes towards Interest, meaning a smaller portion goes towards Principal, and therefore the outstanding loan balance takes longer to be reduced.

The blue bars indicate the loan balance outstanding. The debt reduction is clearly accelerated in the first/ cheaper interest rate scenario.

Of course the biggest repayment shock of all comes for Fixed Interest Only borrowers, who roll off onto both P&I repayments, as well as higher variable interest rates…

Interest Only with P&I revert

| Interest rate | 2.0% | 6.0% (3.0x increase) |

| Initial Interest Only repayments on say $1M loan | $1,667/mth | n/a |

| P&I repayments

(after 3yr revert to P&I) |

$3,997/mth (2.4x increase if rate remains same at 2%) | $6,240/mth (3.7x increase if rate also increases to 6%) |

I can’t imagine too many borrowers being happy about these sorts of increases, however keep in mind even a standard Interest Only to P&I revert after 3 years can result in repayments increasing 2.4x even without any change in interest rates.

This is due to the loan balance not reducing at all during the Interest Only period, and then needing to be paid off in full over the remaining loan which is shorter (e.g. 27 years, rather than 30 years, in the above example).

Clearly borrowers need to watch out for Interest Only periods ending, particularly if they face cashflow constraints, or they don’t have adequate buffers in place, or they are unable to extend Interest Only periods.

But for all borrowers, no matter what their repayment type, they need plans in place to navigate this period of higher interest rates. Assuming property owners see sufficient value in continuing to hold their assets, they could look at ways to increase income, reduce expenses, or even buy more time by digging into cash reserves. They could also consider refinancing both for cheaper interest rates and/ or longer loan terms to improve cash flow.