Bankers aren’t particularly trustworthy, according to the ‘Ipsos Global Trust in Professions survey’, conducted in 22 countries.

People will put their lives in your hands if you’re a doctor (the most trustworthy profession), but apparently not if you’re a politician, or an advertising executive, or a banker…

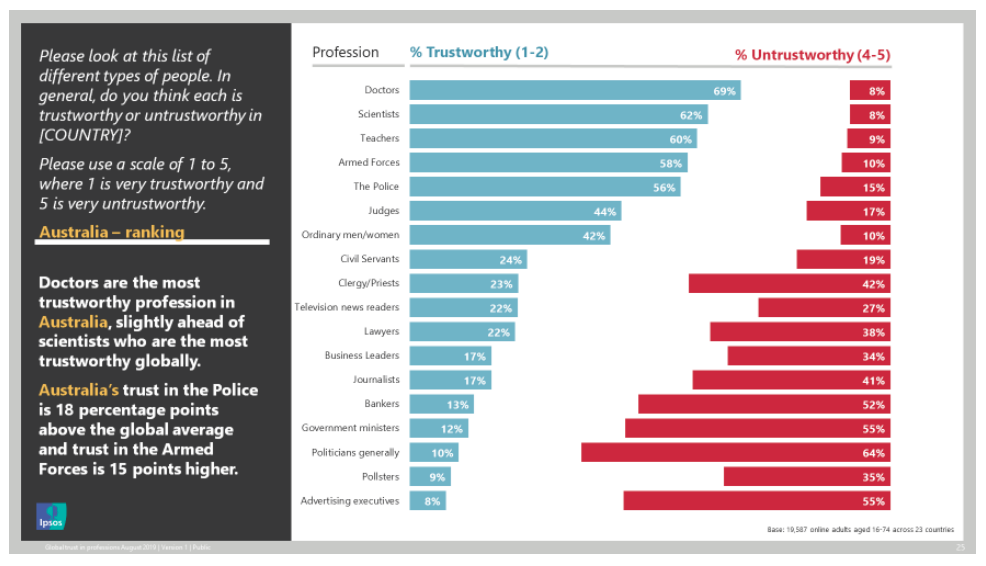

The most and least trusted professions in Australia. (Source: Ipsos)

Last years’ royal commission into the misconduct in the banking, superannuation and financial services industries would unfortunately have only reinforced this sentiment.

And so it was against this backdrop that I was asked to speak at the IQ Club recently. The topic of the presentation – how to develop trust, in the post Hayne era.

What does building trust in the financial services industry mean, and how can it be developed?

I think the epitome of trust is when either as an individual or as an organisation you fail in some way, but then the people negatively affected by that failure (be it your clients, investors, or various other stakeholders) don’t hold it against you, and they are willing to further endorse or back you a second time.

For this to happen, the person or organisation has clearly earned the trust of those around them, most likely through their reliability, integrity and hard work.

How critical can you really be of someone, who is 100% genuine in each of these regards?

The three key messages in my presentation were as follows:

#1 Building trust comes via a relentless focus on adding more and more value for your clients, and making everything else secondary to that.

We would much prefer a great client experience that earns $0.00 initially, rather than a terrible client experience, that makes money.

Think about the long-term value of your client relationships, not just the day 1 economics on single transaction.

#2 Be patient, developing trust takes time.

Consider the example of above. The client who had the positive experience will eventually be speaking to one of their friends or family members, or a colleague at work. When the topic of finance come up, what are they going to say?

If you’re in a word of mouth/ referral driven business, this is where your next opportunity comes from.

It’s a long-term strategy, but a proven and sustainable one, too.

#3 You and your business share the same values.

If your personal values are misaligned, don’t think that there’s any magic formula or potion for your business to be different.

Your business is really just an extension of you. If you don’t genuinely get a buzz out of helping people, and adding value, if making money is your #1 driver, I think it’s difficult to build trust in the financial services industry.

—

I have long held the belief that doing the right thing by clients, is not only the right thing to do morally/ ethically, it’s the best long-term strategy for building a successful business, too. Easy to say, hard to do.

At the IQ Club I discussed the guiding principles which have helped Long Property build a business we’re proud of, and I provided plenty of examples around what this means in terms of our ‘day to day’.

There’s also a part 2 IQ Club presentation next week, so feel free to get in touch if you’re interested in attending.