Article by Patrick Lynch, Head of Operations – Long Property

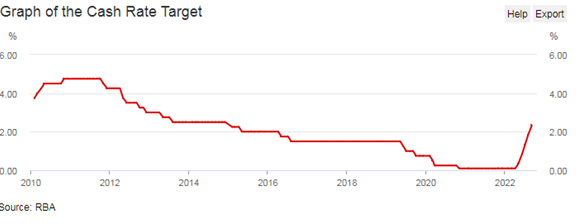

Following 5 successive increases, totalling 2.25%, the RBA cash rate is now 2.35% – the highest since December 2014. Expectations are we’ll see further movements during 2022 and possibly into 2023, pushing rates to levels unseen since 2012.

The reasons why the RBA have decided to move sharply, in contrast to its advice last year that rates wouldn’t move until 2024, can be read in the Governor’s latest statement. In summary, it is about trying to bring inflation down to more reasonable levels.

This obviously has an impact on variable rate borrowers and those due to come off fixed rates in the near term, with higher monthly mortgage payments due to increased interest costs. The ABC calculated that the total increase in monthly repayments on a $750,000 mortgage balance is $922 since the RBA started lifting the cash rate in May – albeit we’re waiting to see whether Lenders will pass on the full 0.5% (highly likely).

So, how can borrowers reduce the impact on their cash flow?

With your existing Lender

Current variable rate, principal and interest, home loans with a ratio of 80% loan to value should be at c 4% (before the September change). If you are significantly more than this, it might be worth contacting your Lender to see if they can meet the market. Often, their Retention team – fearing refinance – will provide a better offer. There is also the opportunity to consider fixed rates, with some good options available.

You might also consider changing your repayment frequency – from monthly (12 per year) to fortnightly (26 per year, depending on Lender) – which can result in significant interest savings.

An offset account won’t reduce the amount you pay, but can reduce the interest charge. If you are fortunate to have access to savings, these can reduce the net loan balance (loan less offset) that the Bank calculates interest on. An offset might have a monthly or annual fee, but could be more beneficial than placing that money in redraw – access to redraw is at your Lender’s discretion.

Look at refinancing

If your existing Lender isn’t playing fair, it could be worth speaking with your Broker about refinancing. Some financial institutions are offering new clients better rates and cash back for switching. Whilst there can be costs to move, the incentive can result in more cash in your pocket.

If you refinance, increasing the loan term can also have a positive impact. Moving from a loan with (say) 23 years remaining to a new 30-year mortgage will reduce the monthly repayment. However, you might end up paying more in interest over the length of the loan. That is why some clients who refinance try to maintain their old repayment – it can save interest and reduce the term.

Other considerations

Focus tends to often be solely on reducing the mortgage cost when rates (and repayments are increasing). But it is important to look at other outgoings, to see if savings can be made elsewhere. See also if there is a way to earn additional income – ‘side hustle’, overtime, etc. You can find some more on this in an old blog post on budgeting here.

If you do anticipate being, or are perhaps are already in, financial distress, it is important to speak with your Broker, Lender or a financial advisor as soon as possible. As well as reviewing your income and expenses, they can look at your loan options such as moving from principal & interest repayments to interest only or pausing payments completely. This can provide temporary relief whilst longer-term solutions are identified and completed.

Conclusion

Whatever your situation, we encourage a regular review of your financial health, in the same way you’d look after your mental and physical wellbeing. Long Property are here to help with your lending needs.

—

This article provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Nothing here constitutes legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.