Patrick has provided some great savings, income and cash flow tips in this article. However before getting into the detail, let’s take a step back… clients first need a plan, and to execute their plan, they need their bank and loan accounts set up correctly.

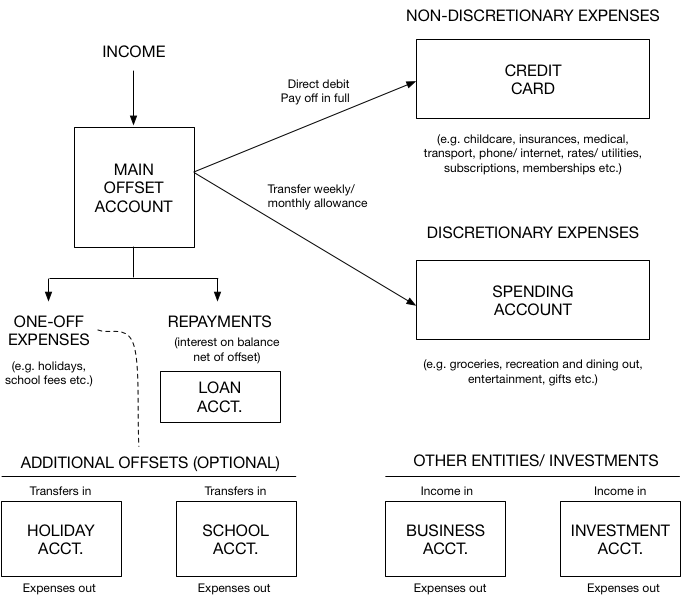

Here’s a simple but effective framework to organise your money.

The key element is to then give yourself a weekly or monthly allowance for discretionary expenses… a set amount for things like clothes and personal care, coffees, restaurants and eating out, movies, gifts, those sorts of things.

If such expenses are confined to one bank account, and you only provide this account with a set level of funds each week or month, then you’re less likely to overspend.

Ideally you can then allocate a percentage of your weekly or monthly income towards an appropriate level of savings and/ or investments, to meet your financial objectives. If your cash flow doesn’t allow for this, then perhaps your discretionary expenditure should be reduced, or more wholesale/ lifestyle changes may be required.

Here’s a visual example of an efficient/ effective account set up for a single or couple with a mortgage:

—

Here’s how the three main accounts work:

Main offset account

- This is the account where your income goes in, and your mortgage repayments go out.

- You can store the bulk of your savings here to reduce the interest you pay on your mortgage.

- The savings can also be used for ‘one-off’ expenses (e.g. holidays, school fees, car registration etc.), and separate accounts can be set up for these items if desired, ideally still offsetting the main mortgage.

By utilising offset accounts correctly, borrowers reduce the interest they pay on their mortgage, since the interest is calculated based on the net balance. For a loan that is principal & interest (set monthly repayments), paying less interest leads to accelerated debt reduction, since by paying less interest a higher allocation of each payment goes towards reducing principal.

For a loan that is Interest Only, paying less interest gives the borrower the opportunity to build up more savings, because the smaller interest payment each month results in surplus cash flow. Interest Only repayments tend to be more suitable for investors, since they can improve cash flow and maximise potential gearing benefits, however Interest Only rates are more expensive in the current market, and debt reduction can be a lower risk approach.

Credit card account (for non-discretionary expenses)

- This is the account you can use for direct debits, and all non-discretionary expense items.

- To avoid interest being charged, set up a direct debit from your offset account to ensure this regularly gets paid off in full (this is a key money management principal, credit card interest tends to be expensive and non-tax deductible, it should be avoided).

- It’s not as important to track expenditure from this account since it tends not to fluctuate very much (just make sure whatever you’re spending here fits in with a sensible overall plan).

- Paying for these items from a credit card means you can keep more cash if your offset for longer.

- If your card is linked to an awards program, accruing these expenses on your card may also earn ‘points’, which can be redeemed for things like gifts, discounted airfares, online shopping etc.

- If you’re not disciplined or you just prefer not having a credit card, then you can instead make this account a transaction account (again ideally also offsetting your loan).

Spending account (for discretionary expenses)

- This is the low-hanging fruit, this is where you can really save!

- Transfer in your set amount each week or month for all discretionary items (transfer from the savings in your main offset account, again ideally funds in this transaction account are still offsetting your loan).

- If it’s nearing the end of the week or month, and you’re running low on funds, slow down… resist the temptation of transferring more savings in from your offset!

With the trend now towards a cashless economy, it’s easy just ‘tapping a card’ and getting carried away with your spending (it doesn’t feel like spending!). The problem is exacerbated when you draw from an offset account that is flush with money, or by spending on a credit card with a big limit (it can be dangerous feeling rich!).

The above money management framework is simple but powerful. It first helps you figure out what you’re currently spending (most people have no clue), and then it forces you to consider this within the context of a higher level financial goal or plan. Then by giving yourself a weekly or monthly allowance for discretionary expenses, and by paying these expenses from the one/ isolated ‘spending’ account, it encourages discipline.

You don’t have to be a scrooge with money. At least just be organised!