The latest ABS lending indicator statistics reveal there was an explosion in refinancing in May 2020, taking total lending to owner-occupiers up to record monthly highs.

If you recall this was off the back of aggressive pricing and cashback offers largely driven by the major banks.

But once you strip out the massive surge of refinancing approvals there was the expected decline in housing lending, as the economy was largely shut back in May.

New housing loan approvals for May (excluding refinances) fell dramatically, down -11.6% m/m and -4.8% previously.

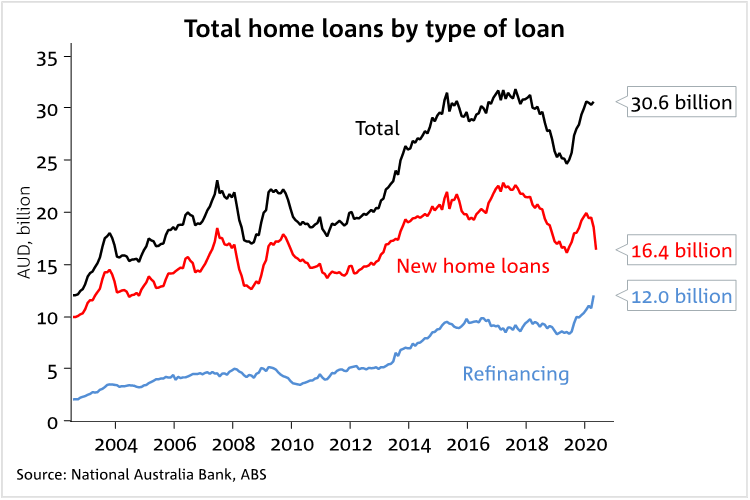

This below chart sums it up best, and reflects what we’ve experienced at Long Property (e.g. a steady increase in lending but with a much higher than usual proportion of refinances):

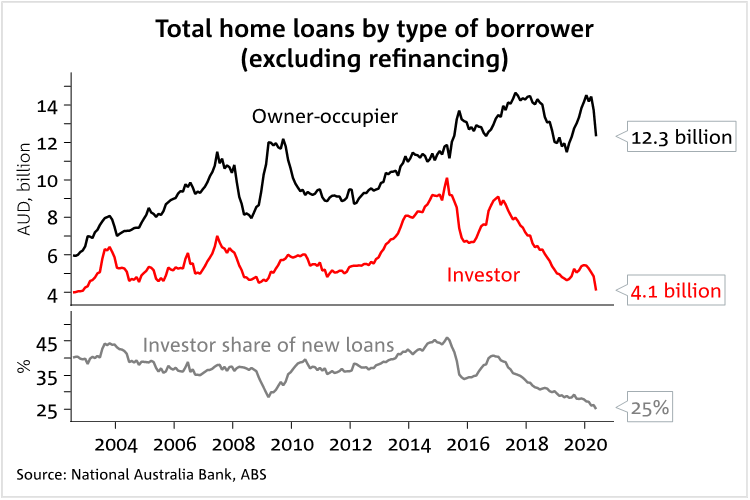

There were sharp falls for both investors (-15.6% m/m) and owner-occupiers (-10.2% m/m) with the investor share of the market falling to 25% – below the lows seen during the GFC!

It’s fascinating to see such movements in housing finance, particularly for property investors. Between 2012 to 2015 the Melbourne and Sydney property markets were pushed so hard by investors that APRA intervened by forcing the banks to cap investment lending and restrict the flow of new Interest Only loans.

Bill Shorten also campaigned on abolishing negative gearing and reducing capital gains tax discounts for investors.

If the latest finance trends continue, perhaps policies going in the opposite direction might be considered. Or perhaps the banks move to simplify their pricing structures again – for a long time interests rates for home loans and investment loans were the same (now investment rates are approximately 20 – 60 bps more expensive).

In response to the finance data, Prime Minister Scott Morrison said it’s too early to make any calls on house prices…

“I think it would be a little premature to be making medium or even short-term forecasts about the Australian property market at the moment,” Mr Morrison said.

“Of course you’re going to see resistance, a concern amongst consumers during the times we’re experiencing right now. It would be surprising if we did not see that.

“But I think, fundamentally, the structural position of the housing markets in Australia would tell a far stronger tale in terms of their resilience.

—

Long Property blog content provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Nothing on the Long Property website constitutes legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.