The royal commission has dominated news headlines this week.

If you’re wondering how it affects you, here’s my take… (responding to the common questions I’m being asked)

Also check our special episode of the Long Property Show podcast where Patrick and I discuss the same matters with industry veteran Stuart Wemyss. (listen here)

What exactly is the royal commission?

Royal commissions are the highest form of inquiry into matters of public importance.

The aim of the banking royal commission was to expose wrong-doing and misconduct in the Banking, Superannuation and Financial services industries.

Does the royal commission affect how I apply to get a loan for a property purchase?

It already has.

Throughout last year there were 68 days’ worth of hearings and the banks were under intense scrutiny.

The banks tightened lending standards, which means it’s now significantly more difficult to get a loan. (there’s a lot more paperwork required, the assessments are more rigorous, you may not be able to borrow as much as you used to be able to, and the process appears to be taking a lot longer)

In the final report which was released on Monday, Commissioner Kenneth Hayne made 76 recommendations, some of which relate to how mortgage brokers should be paid.

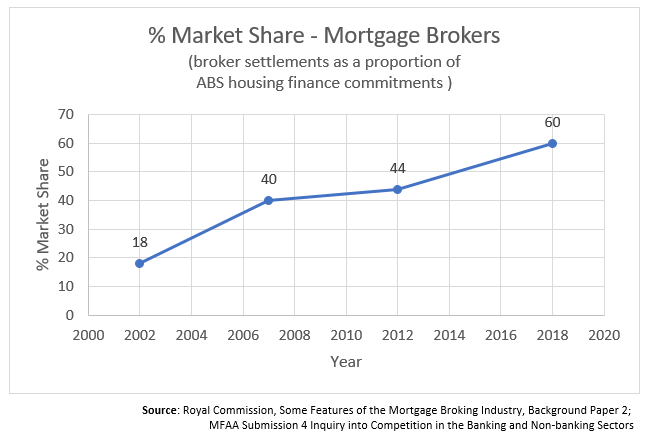

Right now brokers originate 60% of all home loans and investment loans in Australia. If there are less brokers, the major banks (with extensive branch networks), will gain more control.

Will the Royal Commission affect Long Property?

Yes, we will get paid less – but I’m sure we will survive. No one likes earning less money, but thankfully we enjoy our work – therefore if we’re able to continue operating, we will gladly do so.

So why will brokers get paid less?

Right now, we earn an upfront commission, and a smaller ongoing commission (a.k.a. ‘trail’ commission, until such time that the loan ends).

These commissions are paid by the lender, at no cost to the client/ borrower.

The ongoing commission has always served two purposes:

- To ensure we look after the ongoing needs of our clients (e.g. keeping clients informed, assisting with loan maintenance issues, annual reviews, new lending strategies etc.); and

- To improve client retention

The Commissioner has recommended that the ongoing commission be eliminated, and this is likely to be implemented as soon as next year.

He has also recommended that the upfront commission (currently paid by the banks), eventually becomes a ‘fee’, paid for by the client/ borrower.

This is where it gets interesting…

Treasurer Josh Frydenberg is saying there will be “a review in 3 years” to determine whether the borrower should pay [1]. The alternative would be that the lenders continues to pay the fee.

However shadow treasurer Chris Bowen has said the opposition accepts “in principle each and every recommendation” [2], including that the borrower pays.

Philip Lowe, the Head of the Reserve Bank of Australia, agrees trail should go, but says “the government is right to be cautious about going the full way, and making the borrower pay”. [3]

Matt Comyn, the CEO of the Commonwealth Bank, says any new regulation should also require banks to charge customers an equivalent fee “so as to not create an uneven playing field“. [3]

So long as there’s an even playing field, I think most brokers stand a good chance to survive. If it costs no more to use a broker vs. going to the bank directly – as per the current model – then brokers will more often than not win, primarily due to the value proposition – more choice, and better support/ service.

Do I agree with the recommendations given by the royal commission?

Absolutely not.

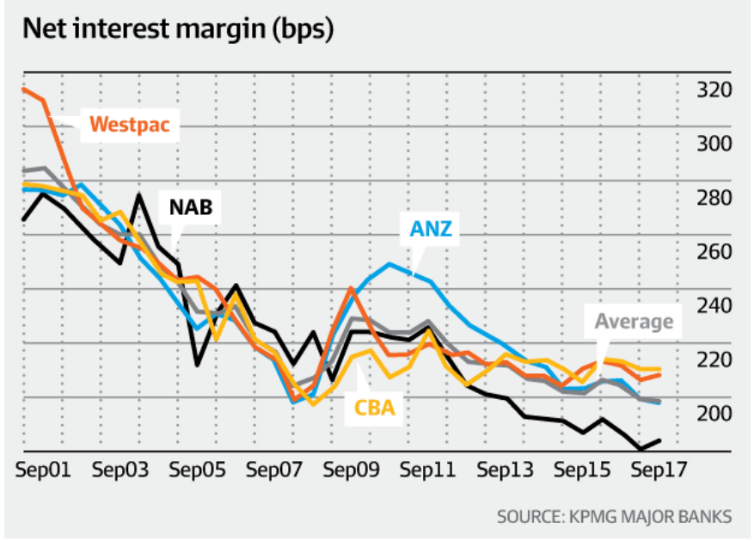

According to the KPMG analysis, the net interest margins of banks has fallen substantially over the past 15 years. This is the result of stronger competition which is driven by mortgage brokers. [4]

By reducing brokers, the recommendations made by Commissioner Hayne will reduce competition.

When the recommendations were released, CBA shares jumped 4.7 per cent to $73.63, Westpac shares rallied 7.7 per cent to $26.79, ANZ shares surged 7.1 per cent to $27.00 and NAB jumped 5 per cent to $25.23. Meanwhile two listed mortgage broking firms lost nearly a third of their value. [5]

This is a disappointing outcome, given the objective of the royal commission was to investigate the misconduct of the banks, as well as the financial services and superannuation industries.

In my opinion, the banks have gotten off very lightly.

I’m not convinced about the flat fee model recommended by the Commissioner, and I’m certainly not in favour of a fee model where the consumer pays.

Wouldn’t this just favour wealthier Australians, those who could more easily afford and justify the fee? This doesn’t seem right.

And when it comes to getting the loan… would you not be incentivised to borrow more, to get more value out of the flat fee? I’m not sure this is in the best interests of consumers either…

I certainly don’t buy the outcome that that by paying brokers less the banks will have cost savings they can pass onto consumers.

Without brokers the smaller lenders will lose their sales channels and I’d imagine the big banks will have to re-build more branches and employ more staff to service the demand.

If the objective of the royal commission was to drive better outcomes for the consumer, I think it falls well short of that, at least from a lending perspective.

A world where consumers have less choices, more fees, and inferior service – seems just the reverse.

When Momentum Intelligence polled nearly 6,000 borrowers they found 96 per cent of respondents were either satisfied or highly satisfied with their broker, while only 67 per cent of respondents said they were satisfied or highly satisfied when dealing directly with a lender. [6]

I think the debate really starts now (this is the beginning, not the end). This will become an interesting political issue.

—

References:

[1] Banking royal commission final report: Coalition pulls punches on broker crackdown, Australian Financial Review – 4 Feb 2019

[2] A dark day for Australian banking’: Royal commission report causes shock waves, SBS – 4 Feb 2019

[3] Right to be cautious’: Philip Lowe, Matt Comyn back a role for mortgage brokers, Australian Financial Review – 6 Feb 2019

[4] Brokers take big bite from big four mortgage revenues, analysis shows, Australian Financial Review – 31 Jan 2019

[5] Banking royal commission: Banks, AMP rally but mortgage brokers smashed, Australian Financial Review – 5 Feb 2019

[6] Consumer access to mortgage report, Momentum Intelligence – 1 Feb 2019

—

Long Property blog content provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Nothing on the Long Property website constitutes legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.

Credit Representative Number 493530 authorised under Australian Credit Licence 389328.