There is no doubt that getting on the property ladder is extremely tough. However over the last 5 years State and Federal governments have introduced a range of initiatives to make things easier for first home buyers. Below are three schemes which can greatly enhance the speed at which you can enter the market. They work by increasing your savings, reducing the deposit requirement and reducing your up-front costs. This article is not an exhaustive list and each scheme has its own intricacies which is beyond the scope of this article, but it is safe to assume that if you are a first home buyer and a permanent resident or citizen of Australia you can benefit from each of the below schemes.

First Home Super Saver

To take advantage of this scheme it is best implemented at least 1-3 years before you think you will purchase. Under the FHSS scheme you can contribute an additional $15,000 per year into your superannuation towards your deposit for your first home (subject to standard contribution limits, currently $27,500 p.a). You can then later withdraw this money along with its associated earnings. The key advantage to saving in your super rather than in a standard bank account is that super contributions are taxed at only 15% rather than your marginal tax rate, which tends to be 34.5% for most first home buyers I work with. For example if you ask your employer to pay an extra $10,000 into your super you pay only $1,500 tax compared to paying $3,450 in tax when taking the cash as part of your regular salary.

The government will also pay you something called the shortfall interest charge. This is interest earned on the money deposited in your superannuation. In the July-Sept 2023 quarter the shortfall interest charge is 6.9% – this is around 1.5% higher than any bank savings rate available right now.

When you withdraw the funds from your super to pay for your deposit you pay a withdrawal tax. This tax is your marginal tax rate minus 30%, for most first home buyers this equates to 4.5% (34.5% marginal tax rate – 30%).

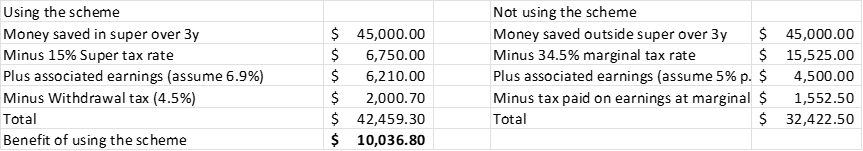

Let’s look at an example where someone contributes an additional $15,000 per year to their super for three years.

You can see in the example above by using the FHSS scheme you have an additional $10,036.80 to contribute to your deposit. This is a c31% boost to your savings.

All of the above works in line with standard superannuation rules and contribution limits which are too in depth for the scope of this article.

The full scheme details can be found here.

Potential boost to your deposit $10,036

First Home Guarantee Scheme

The First Home Guarantee Scheme is an extremely powerful piece of policy that allows you to get on the property market with just a 5% deposit. Traditionally when purchasing if you had less than a 20% deposit, you would have to pay something called Lenders Mortgage Insurance, the exact amount here varies depending on property price and how much of a deposit you are contributing but generally it falls within the $10,000 – $20,000 range for most first home buyers. Under this scheme the government will guarantee 15% of the purchase price meaning you can avoid lenders mortgage insurance. Importantly you still own 100% of the property, this is not a shared equity scheme. Once the total leverage of the property is below 80% the government guarantee can be released. Another benefit of this scheme is improved interest rates, generally when the loan to value ratio exceeds 80% the banks charge you an interest rate premium as they are taking on more risk. However under this scheme the bank assesses you at 80% loan to value ratio meaning you get extremely competitive interest rates.

Some important conditions for this scheme are a max income in the previous financial year of $125,000 for a single borrower and $200,000 for a couple. The max property purchase price also ranges from $600,000 in WA & Tasmania all the way up to $900,000 in NSW.

The full scheme details can be found here

Typical saving $10,000-$20,000 in Lenders Mortgage Insurance plus potentially $1,000’s each year in lower interest rates.

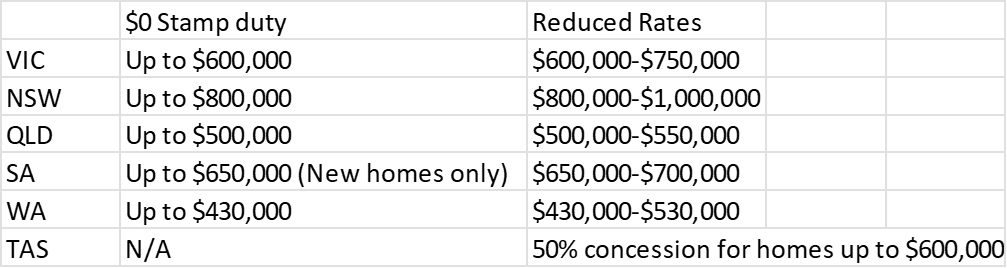

Stamp duty exemption.

Finally after you have saved your deposit and you are ready to purchase most states offer generous concessions for first home buyers. In Victoria, Queensland, New South Wales & Western Australia you can pay $0 in stamp duty up to a designated limit. Full details of the current concessions available are listed below. They are correct as of 2/8/2023.

The above is just a brief snapshot of three potential schemes. I would encourage all first home buyers to do further reading on the above schemes as well as research on the various other schemes which are available.