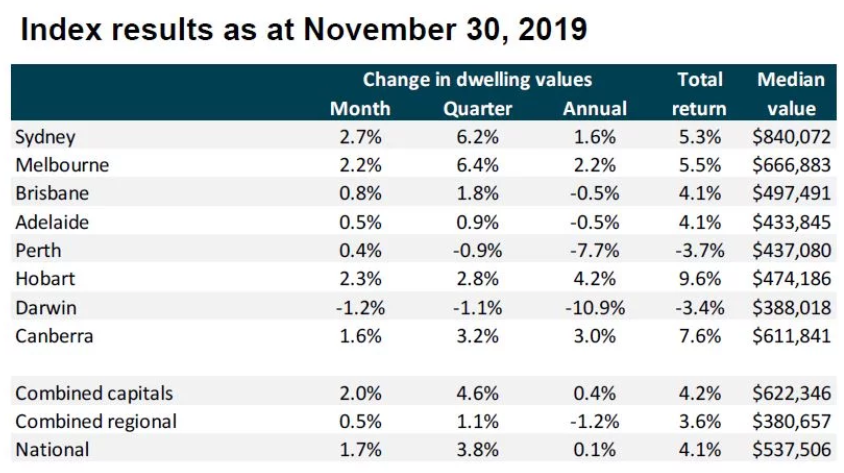

CoreLogic’s national Home Value Index surged 1.7% higher in November delivering the fifth consecutive monthly increase, coupled with the largest monthly gain in the national index since 2003.

Since finding its trough in June earlier this year, the national dwelling value index has recovered by 4.7%.

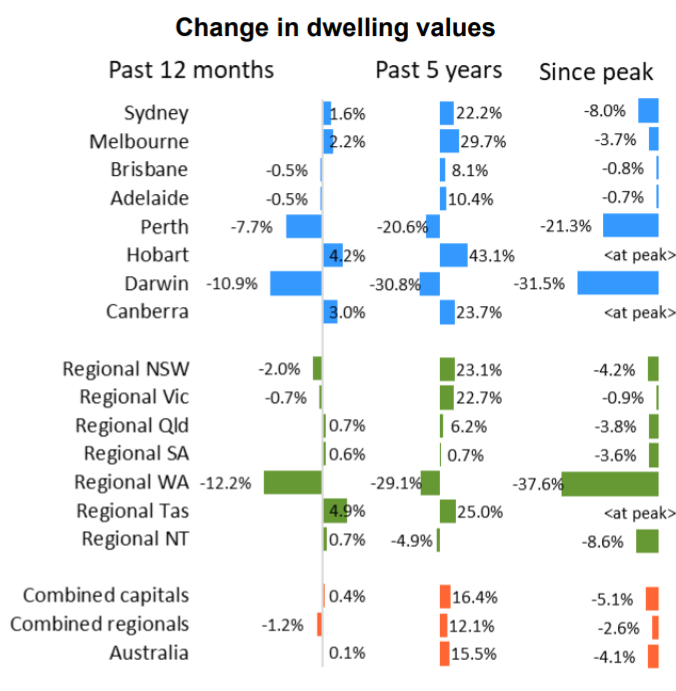

Although values are recovering rapidly, at a national level home values remain 4.1% below their 2017 peak, tracking roughly at the same level as recorded in the January 2017 index results.

Sydney and Melbourne continued to drive the recovery, with values up by 2.7% and 2.2% respectively over the month.

All remaining capital cities, excluding Darwin, demonstrated a broadening in the geographic scope of the upswing, with values rising over the month.

According to Tim Lawless who heads up CoreLogic Research, a variety of factors are supporting the strong gains in housing values.

“The synergy of a 75 basis points rate cut from the Reserve Bank, a loosening in loan serviceability policy from APRA, and the removal of uncertainty around taxation reform following the federal election outcome, are central to this recovery”.

“Additionally, we’re seeing advertised stock levels persistently low, creating a sense of urgency in the market as buyer demand picks up. There’s also the prospect that interest rates are likely to fall further over the coming months and an improvement in housing affordability following the recent downturn are other factors supporting a lift in values.”

Highlights over the three months to November 2019

- Best performing capital city: Melbourne +6.4%

- Weakest performing capital city: Darwin -1.1%

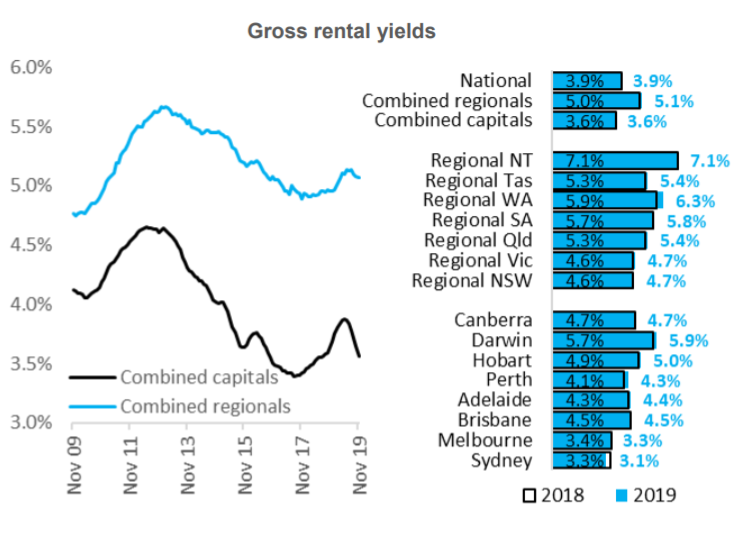

- Highest rental yield: Darwin 5.9%

- Lowest rental yields: Sydney 3.1%

The strongest sub-regions for growth across the capital cities are now in areas of Melbourne and Sydney’s prestige market.

Melbourne’s Inner East, where the median dwelling value is $1.18 million, has surged back to positive annual growth, up 8.0% over the past twelve months. The rapid bounce back follows a significant decline in values across the region, where values fell 18.0% from peak to trough. The largest declines are generally confined to areas of Perth and Darwin, which comprise eight of the ten largest dwelling value declines over the past year.

Rental markets are continuing to show a sluggish performance, with rents unchanged over the month across the combined capitals and rising 0.2% over the month across the combined regional areas of Australia. Rents continued to trend lower in Sydney (-0.1% in November) and were also down slightly in Hobart (-0.6%) and Darwin (-0.5%). The remaining capital cities are generally seeing weak rental market conditions. On an annual basis, the largest rental increases are in Hobart (+5.8%) and Perth (+2.3%), with rents down 1.5% in Sydney and 2.5% lower in Darwin over the year.

Tim Lawless said, “Softer rental conditions can be attributed to a range of factors including the recent history of rising rental supply, demonstrated by unprecedented levels of investment participation in the housing market between 2012 and 2017, as well as a significant increase in dwelling construction skewed towards rental accommodation in the high rise apartment sector. Additionally, a larger than normal number of renters have transitioned to first home buyers, thereby denting rental demand.”

Although gross rental yields are trending lower, so too are mortgage rates.

At the end of October, the average three-year fixed rate for an investor mortgage was 3.48%.This is now lower than capital city gross rental yields for the first time since at least 2007 (when CoreLogic’s rental yield series commences), implying that more properties will be showing a positive cash flow for investors, and paying off a mortgage may be more affordable than paying rent in many areas.

Smaller cities are starting to show a stronger growth trajectory in the housing market.

As housing affordability becomes more pressing, jobs growth fades and unemployment ticks higher across New South Wales and Victoria, the smaller capital cities may be beneficiaries of increased demand.

Based on data to June from the Australian Bureau of Statistics, there is a clear trend towards stronger interstate migration rates into Queensland as well as a reduction in the interstate outflow from South Australia and Western Australia.

More affordable housing options across the smaller cities are likely to be attractive to interstate residents, however jobs growth and the employment rate is generally weaker relative to the larger cities which remains a barrier to higher housing demand.

The Australian housing market is now five months into an unexpected period of rapid recovery. The question is, how long can such a high pace of capital gains be sustained?

“Annualising the growth rate over the past three months implies the national index is already tracking well above double digit annual growth (+15.3%), while Sydney and Melbourne dwellings are tracking around the mid-twenty percent range for annualised capital gains based on the most recent three month trend.

“Considering wages and household income growth remains low, economic conditions are losing momentum and housing affordability is once again worsening (from an already high base in the largest cities), there are likely to be some headwinds in maintaining such a fast recovery.”

“Additionally, the market is yet to be tested on higher supply levels. Advertised listing numbers have remained seasonally low throughout spring due to low new listing numbers and an increased rate of absorption as buyer demand lifts.”

“With selling conditions looking very strong, there is a high probability that listing numbers will show a material lift through the first quarter of 2020 which will test the depth of the market, and likely ease some of the urgency that is contributing to higher prices.”

Will a further reduction in interest rates, counteract some of the headwinds?

“Mortgage rates are already at their lowest level since at least the 1950’s which is one of main factors supporting increasing market activity. If rates do move lower, no doubt policy makers will be watchful for any triggers that could provoke a policy response limiting housing credit. Previous rounds of macro-prudential [tightening] have had an immediate slowing effect on market activity.”

Tim Lawless in the head of CoreLogic’s RP Data research and analytics team. Visit www.corelogic.com.au