A wealth mindset is a critical attribute among successful property investors.

Did you know approximately 50% of investors sell their properties within five years? [1]

To illustrate how detrimental this can be, have a look at this example of an investment property growing at 7% p.a. (e.g. doubling every ten years).

Scenario 1 (you sell early):

- Day 1 – Buy $1.0 million property with $1.0 million debt – leverage 100%

- Year 5 – Sell investment property, worth $1.4 million after five years

Scenario 2 (you hold for longer):

- Year 10 – Property is worth $2.0 million, debt is still $1.0 million – leverage 50%

- Year 20 – Property is worth $4.0 million, debt is still $1.0 million – leverage 25%

Scenario 1 leaves you with a relatively small amount of cash which will become increasingly worthless due to inflation. Scenario 2 sets you up for retirement, and the only difference is that you held the investment for fifteen years longer.

Assuming you’ve bought investment-grade properties, and financed them sensibly, a wealth mindset says, how can I hang in here?

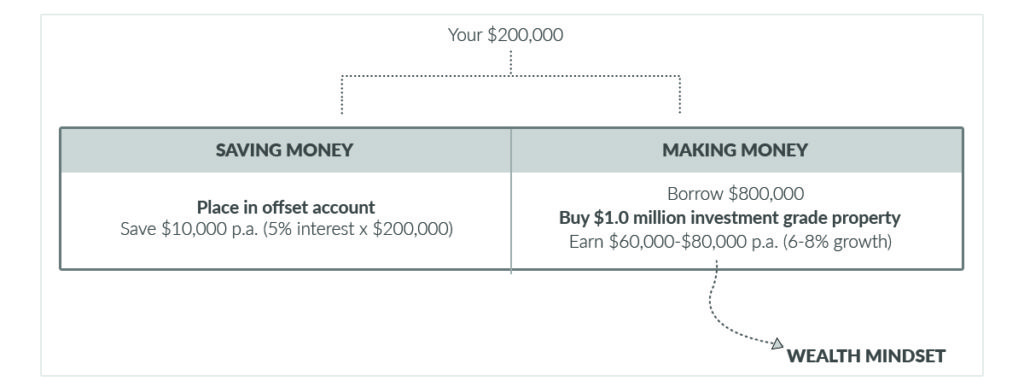

Consider this second example . . .

- Say you had $200,000 in your offset account against your home loan, with your interest rate at 5.0%.

- With this money in place you might be saving $10,000 p.a. in interest costs (e.g. $200,000 x 5.0% = $10,000).

- But using this $200,000 and borrowing a further $800,000 to buy a new $1.0 million property . . . this might make you $60,000-80,000 p.a. (if you achieved 6-8% p.a. capital growth).

- Your interest repayments would obviously be higher (say 5% x $800,000 = $40,000), but you would also be receiving rent on a $1.0 million asset (say 3% net x $1.0 million = $30,000), and any negative cash-flow is likely to be tax deductible as well. The net costs would be significantly smaller than the potential gains.

What would you rather do, save $10,000 p.a. or potentially make $60,000-80,000 p.a.? [2]

Less than 10% of property investors in Australia ever own more than two investment properties. [3]

A wealth mindset gives you confidence to spend money to make money.

A wealth mindset asks how can I acquire more appreciating assets?

—

References

[1] “The 5 Pillars of Smart Property Investing,” Metropole, https://metropole.com.au/5-pillars-smart-property-investing/ (accessed February 25, 2018).

[2] For simplicity this example does not take into account additional purchase costs like stamp duty. You would also need sufficient income/borrowing capacity to safely get an investment loan for the additional $800,000.

[3] “What Percentage of Australians Own Investment Property,” OnProperty, http://onproperty.com.au/percentage-of-australians-own-property/ (accessed February 25, 2018).