How much have Australian house prices fallen due to COVID19?

Has the possibility of a 20-30% correction all but gone now?

These questions were answered in a recent article by Dr. Shane Oliver, Head of Investment Strategy and Chief Economist at AMP Capital.

On 19 March, when Shane first looked at the impact of the intensifying shutdown of the Australian economy on the housing market, he concluded that the impact would depend on how high unemployment rose (see here).

His base case was a recession that saw unemployment rise to around 7.5% and would push average home prices down around 5%, but the downside risk was that a deeper downturn with say 10% unemployment could see a 20% fall in house prices.

Shane now believes that the subsequent government support measures along with an earlier reopening of the economy have reduced the risk of worse case scenarios for home prices.

A large reduction in stock levels has softened the blow to house prices

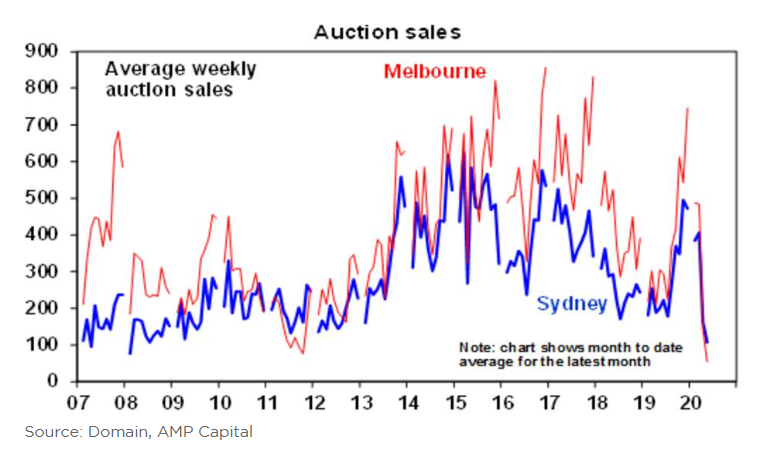

Since March the number of properties for sale has fallen dramatically, largely due to fear of a weak market, the need for social distancing and the temporary ban of on-site auctions.

In addition, the Federal Government’s JobKeeper and JobSeeker schemes (which have kept around 3.5 million people in paid employment and doubled unemployment benefits), along with bank mortgage payment holidays, have helped head off an increase in ‘forced sales’ that might otherwise have occurred, given the hit to the economy.

So while property demand has fallen, it has been offset to an extent by the decrease in supply, which has left the property market more stable.

House prices have started to fall – according to CoreLogic, growth in average capital city home prices slowed to 0.2% in April, and then fell -0.5% in May – however it has not been dramatic.

The five positives for the property outlook

- Interest rates have fallen to record lows (improving affordability, boosting demand).

- As explained above stock levels remain very low (largely offsetting the fall in demand).

- Government support measures have boosted household income and supported employment, plus mortgage repayment holidays have prevented a sharp rise in mortgage defaults.

- The shutdown, impacting mostly service and retail jobs, has not hit all earners in the same way as past recessions, thus further averting defaults.

- China is running 2-3 months ahead of Australia with respect to the coronavirus shock and its experience provides some guide. While property sales in China were near zero in the peak lockdown month of February, average property price growth slowed but did not go negative, and is now picking up a bit.

I would also add that Australia has dealt with the health crisis well and now that the economy is reopening (sooner than many expected) the risk of a second wave of infections has been reduced. Australia also had a strong budget going into the pandemic and there was a lot of momentum in the housing market.

The three negatives for the property outlook

- High unemployment – once the support measures end later this year, measured unemployment will likely rise to around 8% and take a long time to fall back to the pre-coronavirus levels of around 5.2%, this in turn is likely to lead to some increase in mortgage defaults and act as a drag on demand.

- Drop in immigration – thanks to travel bans, the Government expects net immigration to fall to just below 170,000 this financial year and to around 35,000 next financial year, from 240,000 last financial year. This is a huge hit, and if it occurs – the Government could always allow a faster return of immigration – it will take population growth over 2020-21 to just 0.7%, its lowest since 1917.

- Falling rents and rising vacancy rates – vacancy rates rose sharply in April and this plus rent relief is putting downwards pressure on rents. This will be further impacted by very low immigration. It will weigh on investor demand and may cause problems for heavily geared property investors.

Conclusion

Shane’s base case is for national average house prices to fall around 5-10% into next year.

This may be seen as a reasonable outcome in terms of making housing more affordable, but without posing a big threat to the economy at the same time.

Dr Shane Oliver is Head of Investment Strategy and Chief Economist at AMP Capital. You can read the original article here.

Long Property blog content provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Nothing on the Long Property website constitutes legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.